Are you ready to unlock the secrets to building a robust financial future? In today’s fast-paced world, it’s more crucial than ever to take control of your retirement savings. But where do you begin? Discover the smart strategies that can help you maximize your savings and secure the retirement you deserve.

Key Takeaways

- Leverage tax-advantaged accounts like 401(k)s and IRAs to grow your savings faster

- Capitalize on employer matches and catch-up contributions to boost your nest egg

- Automate your savings to make it a seamless part of your financial routine

- Diversify your investments to manage risk and maximize long-term returns

- Prioritize paying off high-interest debts to free up funds for retirement savings

Retirement planning may seem daunting, but with the right mindset and strategies, you can take control of your financial future. By understanding the power of compound interest, maximizing your contributions, and utilizing tax-advantaged accounts, you can significantly improve your chances of a secure and comfortable retirement1.

Start by exploring your employer’s 401(k) plan. In 2023, employees can contribute up to $22,500, with an additional $7,500 allowed for those over age 50, reaching a total of $30,0001. If your employer offers matching contributions, be sure to take advantage of this free money to boost your savings2.

Another powerful tool in your retirement savings arsenal is the individual retirement account (IRA). In 2023, the contribution limit is $6,500, or $7,500 for those aged 50 and above1. Depending on your income and eligibility, you may benefit from a traditional or Roth IRA, each offering unique tax advantages2.

Remember, it’s never too late to start saving. Even small, consistent contributions can make a significant difference over time thanks to the power of compound interest2. By automating your retirement contributions, you can ensure that your savings grow steadily without constant manual intervention2.

As you navigate your retirement planning journey, don’t forget to address high-interest debts and prepare for healthcare costs1. By taking a holistic approach and making informed decisions, you can maximize your retirement savings and pave the way for a secure and fulfilling future.

Understand the Importance of Retirement Savings

Preparing for retirement is key, as it can last 30 years or more3. To live comfortably, you might need 80% of your current income3. Yet, the average Social Security benefit is just $1,200 a month3. This shows how vital personal savings are to fill the gap.

Why Start Early?

Starting to save early is crucial because of compound interest3. For example, saving $200 a month at 6% interest can grow to $14,024 in 5 years3. It grows to $58,455 in 15 years and $92,870 in 20 years3. Waiting to save can make reaching your goals harder, so start early.

The Power of Compound Interest

Compound interest can make your savings grow fast over time3. Saving $200 a month at 6% for 5 years can grow to $3,5063. For 15 years, it grows to $14,614, and for 20 years, to $23,2183. Early and consistent saving maximizes compound interest benefits.

Setting Clear Financial Goals

Setting clear financial goals is vital for retirement planning4. Think about your retirement age, lifestyle, and healthcare costs4. Retirement calculators can help estimate your savings needs and track your progress.

“Retirement planning should ideally start in one’s early-to-mid 20s, but it’s never too late to begin saving.”4

Understanding retirement savings, starting early, using compound interest, and setting goals are key steps345. They help ensure a secure and comfortable retirement.

Evaluate Your Current Retirement Savings

To make sure you’re on track for retirement, it’s important to check your retirement accounts. Look at your 401(k)s, IRAs, and other savings. The calculator starts with a balance of $65,000.00, based on 2019’s median retirement savings6.

Analyzing Your Existing Accounts

Check how your investments are doing and if you need to change your portfolio. Think about asset allocation, risk, and fees. A diverse portfolio can help you through market ups and downs and grow your savings7.

The Standard & Poor’s 500® saw a 10.3% average annual return from 1970 to 20167.

Identifying Gaps in Savings

Use online calculators to see if you’re on track for retirement. These tools can spot savings gaps and show how much more you need to save8. By 35, aim to save one to one-and-a-half times your current salary8.

Reviewing Employer Contributions

If your employer matches your 401(k) contributions, make sure to use this benefit6. In 2023, you can contribute up to $22,500.00, with an extra $7,500.00 if you’re 50 or older6. Employer matches can greatly increase your savings, so don’t miss out.

By reviewing your retirement savings, you can find ways to improve. Start saving early and consistently. Use all resources and opportunities to reach your financial goals.

Choose the Right Retirement Accounts

Understanding your retirement account options is key. 401(k) plans and Individual Retirement Accounts (IRAs) are popular. They both offer tax benefits, but differ in important ways.

401(k) Plans vs. IRAs

401(k) plans are offered by employers. They let you save a part of your income before or after taxes. Many plans also match your contributions, adding to your savings9.

The 2024 limit for 401(k) contributions is $23,000. For those 50 and older, it’s $30,500, including catch-up contributions9.

IRAs, on the other hand, are accounts you manage yourself. In 2024, you can contribute up to $7,000 if under 50. For those 50 and older, it’s $8,0009. IRAs let you invest in a wide range of assets, like stocks and bonds.

Roth vs. Traditional Accounts

Think about how your contributions are taxed. Traditional accounts let you contribute before taxes but you’ll pay taxes later9. Roth accounts use after-tax dollars, so you won’t pay taxes in retirement9. Roth IRAs have income limits, affecting who can contribute directly9.

The Role of Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are also important for retirement planning. They let you save for medical expenses tax-free9. While not for retirement, HSAs can help your financial health later on.

Choosing the right accounts depends on your income, taxes, and goals. Knowing the differences helps you make the best choices for your retirement savings.

“Retirement planning is not a one-size-fits-all approach. It’s essential to evaluate your unique financial situation and choose the right combination of accounts to meet your long-term goals.”

Create a Consistent Contribution Plan

To have a comfortable retirement, saving and investing consistently is key. Setting up automatic transfers to your retirement accounts is a smart move. It means a part of your income goes to your future before you spend it on other things10.

It’s also important to manage your budget well. Look at how you spend money and find ways to cut down on unnecessary costs. Try to put at least half of any raises or bonuses into your retirement savings1011.

Setting Up Automatic Transfers

Automating your retirement savings is a smart way to grow your wealth. By setting up regular transfers from your account to your 401(k) or IRA, your savings will keep growing. This happens even when you’re not thinking about it11.

Managing Your Budget Effectively

Good budgeting is the base of a strong retirement savings plan. Look at how you spend money and find ways to cut down on things you don’t need. Use budgeting tools or apps to track your spending and find ways to save more11.

Increasing Contributions Over Time

As your income goes up, so should your retirement savings. Try to put at least half of any raises or bonuses into your retirement savings. This steady increase can really add up to a big nest egg over time11.

“Saving consistently for retirement is essential, as even modest and steady contributions can build into substantial savings over time.”11

By sticking to a consistent savings plan, you can take charge of your retirement savings. Remember, every small step today can lead to big rewards later.

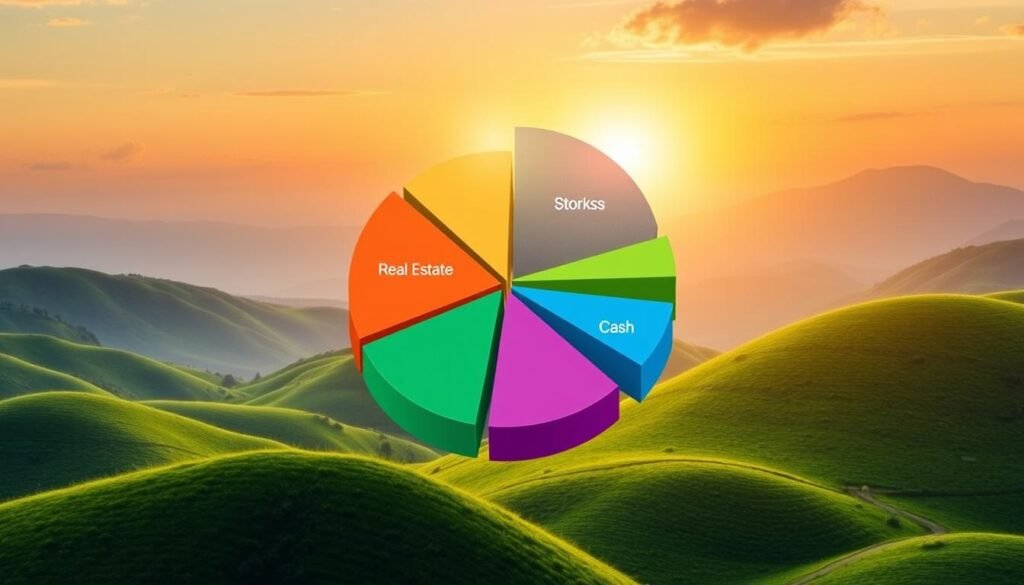

Diversify Your Investments Wisely

Planning for a comfortable retirement means understanding asset allocation and diversification. Asset allocation is about dividing your investments among different types, like stocks, bonds, and cash. Diversification spreads your investments across various sectors and regions to manage risk and returns.

Understanding Asset Allocation

Your asset allocation should match your risk tolerance, financial goals, and time horizon. Younger investors might choose a more aggressive portfolio with stocks. Those nearing retirement might prefer bonds and cash for safety.

As you get closer to retirement, it’s wise to move your portfolio to more conservative investments. This helps protect your savings and ensures a steady income.

Types of Investments to Consider

Building your retirement portfolio should include a variety of assets. Consider stocks, bonds, cash, real estate, commodities, and alternative investments. The right mix depends on your risk tolerance and goals12.

Adjusting Your Portfolio as You Age

As you near retirement, it’s smart to make your portfolio more conservative13. You might reduce stocks and increase bonds and cash. This helps keep your savings safe and provides a steady income.

Regularly rebalancing your portfolio keeps it aligned with your goals12. Getting advice from a financial advisor can help tailor a strategy for your unique needs12.

Take Advantage of Employer Matches

One of the smartest moves you can make is to use employer matching contributions in your 401(k) plan. These contributions are like free money for your future. It’s important to know how to make the most of this benefit.

Maximizing Your Company Contributions

The average employer match is 4.6% of your salary, with some offering up to 7%14. Most matches are $0.50 for every dollar you contribute up to 6% of your salary14. By contributing enough to get the full match, you can increase your retirement savings without spending extra money.

Understanding Vesting Schedules

Knowing your employer’s vesting schedule is key. It shows when you can fully own the employer contributions. On average, it takes five years to be fully vested in a 401(k) plan14. Staying with your employer helps you get the most from their matching contributions.

Strategies for Catch-Up Contributions

If you’re 50 or older, you can make extra catch-up contributions. In 2024, those under 50 can contribute up to $23,000, and those 50 and older can add an extra $7,50014. The total you can contribute in 2024 is $69,000, or 100% of your income, whichever is less14. For those 50 and older, the limit is $76,500, including catch-up contributions14.

By using your employer’s matching contributions, vesting schedules, and catch-up options, you can grow your retirement savings fast. This will help secure a more stable financial future for you.

“An employer match is a top-desired benefit after health insurance, according to an online survey conducted by OnePoll and Human Interest.”15

Employer contributions to 401(k) plans are tax-deductible for businesses. The IRS sets a limit, or it can be up to 25% of what they pay employees15. The SECURE Act 2.0 also offers a tax credit to small businesses for retirement plans, helping with their contributions15.

Using your employer’s retirement plan matching and contribution strategies can greatly improve your financial security16. By taking advantage of these benefits, you can significantly increase your retirement savings. This will help you have a more comfortable and confident future.

Regularly Review and Adjust Your Strategy

Retirement planning is a dynamic process that needs regular updates. As your life changes, so should your retirement plan17. It’s important to review your retirement plan every year, especially with changes in job, income, family, and lifestyle17.

Don’t put retirement planning on autopilot, as it can be risky18.

Monitoring Your Progress

It’s key to track your retirement savings to meet your goals. Use online tools and calculators to check your investments’ performance17. Also, update your retirement account login credentials yearly for security17.

Making Necessary Adjustments

Be ready to adjust your savings rate or investment strategy as your life changes18. Consider age, marital status, health, job changes, and big changes in assets, debt, or expenses18. Small changes to your retirement plan each year can make a big difference17.

Seeking Professional Financial Advice

While managing your retirement planning is crucial, getting professional advice can be beneficial. A financial advisor can offer insights and guidance to align your retirement planning with your goals18. Annuities can provide stable income in retirement, but they may affect death benefits, cash value, and future earnings18.

By regularly reviewing and adjusting your retirement strategy, you can stay on track to achieve your financial goals and enjoy a secure and fulfilling retirement17.

Educate Yourself on Retirement Savings Options

Improving your financial literacy is key for good retirement planning and smart investment education. There are many resources to help you learn about retirement savings and managing investments.

Resources for Financial Literacy

Trustworthy financial groups and organizations have lots of educational materials. Check out the Social Security Administration, FINRA, and the IRS for the latest on retirement planning19.

Workshops and Seminars

Workshops and seminars on retirement planning and investing offer great insights. Many financial services firms, local banks, and community groups host these events for free. You can learn from experts and create a solid retirement plan20.

Online Tools and Calculators

Use online tools and calculators to figure out your retirement needs. They help you set a savings rate, choose investments, and estimate your retirement income. Look for free educational content from financial services to learn about investment strategies and retirement planning2019.

“Investing in your education is one of the best ways to secure your financial future.”

By looking for these educational resources, you can make smart choices about your retirement savings and investment strategies. A lifelong learning approach will prepare you for the changing financial world and help you reach your financial goals.

Plan for Healthcare Costs in Retirement

As you get closer to retirement, it’s key to plan for your future medical costs. The Fidelity Retiree Healthcare Cost Estimate shows a 65-year-old might need up to $165,000 for healthcare in 202421. But, only 41% of adults over 60 feel sure their savings will cover it21.

Estimating Future Medical Expenses

Healthcare will likely be a big part of your retirement costs, after housing and car expenses22. Knowing the costs of Medicare, prescription drugs, and other expenses is vital. Also, think about long-term care, as nearly 70% of those turning 65 will need it23.

The Importance of Long-Term Care Insurance

Protecting your retirement savings from long-term care costs is key. While 28% of 50-64-year-olds have saved for future care, 48% of those 65 and older have23. Long-term care insurance can help. In 2022, a couple aged 65 could pay $9,675 a year for coverage23.

Strategies for Funding Healthcare Needs

Use Health Savings Accounts (HSAs) to fund your healthcare in retirement. In 2024, you can deduct up to $4,150 for individual or $8,300 for family coverage21. Also, delaying Social Security can boost your monthly payments, helping with healthcare costs. Social Security will replace about 42% of your income for medium earners, with a max of $4,018 monthly in 202521.

FAQ

Why is it important to start saving for retirement early?

How can I set clear financial goals for my retirement?

How do I analyze my current retirement savings accounts?

What are the differences between 401(k) plans and IRAs?

How can I create a consistent retirement savings plan?

Why is diversification important in managing my retirement investments?

How can I maximize my employer’s retirement contribution matching?

How often should I review and adjust my retirement savings strategy?

What resources are available to improve my financial literacy for retirement planning?

How can I plan for healthcare costs in retirement?

Source Links

- How To Maximize Your Retirement Savings | Bankrate – https://www.bankrate.com/retirement/how-to-maximize-retirement-savings/

- 10 Different Ways to Help You Boost Your Retirement Savings – https://www.merrilledge.com/article/10-tips-to-help-you-boost-your-retirement-savings-whatever-your-age-ose

- Benefits of setting up a retirement plan – https://www.irs.gov/retirement-plans/plan-sponsor/benefits-of-setting-up-a-retirement-plan

- No title found – https://www.sharonview.org/money-matters-blog/detail/sharonview-blog/2024/08/29/why-is-retirement-planning-important

- 9 Reasons Why Retirement Planning is Important – https://www.covenantwealthadvisors.com/post/9-reasons-why-retirement-planning-is-important

- Retirement Savings Calculator: Project Your Income in Retirement | Human Interest – https://humaninterest.com/learn/calculators/retirement-savings-calculator/

- Bankrate.com – Compare mortgage, refinance, insurance, CD rates – https://www.bankrate.com/retirement/retirement-plan-calculator/

- T. Rowe Price Personal Investor – You’re age 35, 50, or 60: How much should you have saved for retirement by now? – https://www.troweprice.com/personal-investing/resources/insights/youre-age-35-50-or-60-how-much-should-you-have-by-now.html

- Retirement accounts–which is right for you? | Vanguard – https://investor.vanguard.com/investor-resources-education/retirement/savings-retirement-accounts

- Top 10 Ways to Prepare for Retirement – https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/dol-top-10-ways-to-prepare-for-retirement-booklet-2023.pdf

- Starting Early and Staying Consistent Can Help Achieve a Secure Retirement – https://www.guidestone.org/Resources/Education/Articles/Retirement/Start-Early-and-Stay-Consistent

- Diversifying Your Investments for a Secure Retirement Income – https://www.linkedin.com/pulse/diversifying-your-investments-secure-retirement-income-jeff-gill-1nxcf

- What Should Your Retirement Portfolio Include? – https://www.schwab.com/retirement-portfolio

- How 401(k) Matching Works – https://www.investopedia.com/articles/personal-finance/112315/how-401k-matching-works.asp

- 401(k) employer match rules: 10 things for employers to know | Human Interest – https://humaninterest.com/learn/articles/10-things-employers-need-to-know-about-401k-employer-match/

- The Benefits of Offering an Employer Match with a 401(k) Retirement Plan – Slavic401k – https://slavic401k.com/resources/the-benefits-of-offering-an-employer-match-with-a-401k-retirement-plan/

- 5 reasons you should complete an annual retirement plan review – https://www.fultonbank.com/Education-Center/Retirement/Review-your-Retirement-Plan-Annually

- Retirement strategy review: 6 factors to consider – https://www.protective.com/learn/retirement/retirement-strategy-review-6-factors-to-consider

- Consumer Financial Education: Savings & Planning for Retirement – https://dfpi.ca.gov/news/insights/consumer-financial-education-savings-planning-for-retirement/

- Retirement Planning: A 5-Step Guide for 2024 – NerdWallet – https://www.nerdwallet.com/article/investing/retirement-planning-an-introduction

- How to Plan for Medical Expenses in Retirement – https://www.investopedia.com/retirement/how-plan-medical-expenses-retirement/

- How to plan for rising health care costs | Fidelity – https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

- How to Prepare for Healthcare Expenses in Retirement – https://www.ml.com/articles/healthcare-in-retirement.html